Nj Salary Calculator . Check out our new page tax change to find out how federal or state tax changes affect your take home pay. This free, easy to use payroll calculator will calculate your take home pay.

How To Use A Salary Calculator For Your Career The Muse from pilbox.themuse.com The tool provides information for individuals, and households with one or two working adults and. New jersey fiscal year starts from july 01 the year before to june 30 the current year. You only pay taxes on contributions and earnings when the money is withdrawn. The weekly benefit rate is capped at a maximum amount based on the state minimum wage. To use our new jersey salary tax calculator, all you have to do is enter the necessary details and click on the calculate button.

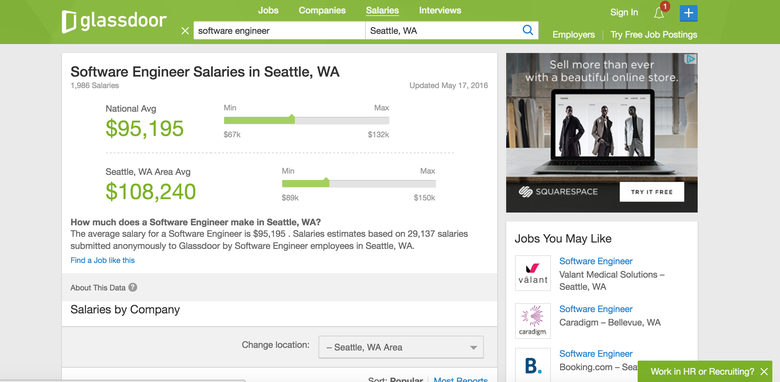

This calculator has been updated to use the new withholding schedules for 2017. Below are your new jersey salary paycheck results. Select a state to add state and local taxes. This calculator is intended for use by u.s. For a detailed calculation of your pay as a gs employee in new jersey, see our general schedule pay calculator. Below are your new jersey salary paycheck results. Job seekers salary calculator program.

Source: lh3.googleusercontent.com The new jersey salary calculator is a good calculator for calculating your total salary deductions each year, this includes federal income tax rates and thresholds in 2021 and new jersey state income tax rates and thresholds in 2021. Calculates federal, fica, medicare and withholding taxes for all 50 states. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Calculates federal, fica, medicare and withholding taxes for all 50 states. This free, easy to use payroll calculator will calculate your take home pay. The new jersey salary comparison calculator is a good calculator for comparing salaries when you are actively looking for a new job, if you would like to compare your current salary to your new salary after a pay raise or compare salaries when looking at a new employment contract, maybe you are an expat reviewing different salaries overseas and their impact on income tax in the us.

You only pay taxes on contributions and earnings when the money is withdrawn. At the lower end, you will pay at a rate of 1.40% on the first $20,000 of your taxable income. We will calculate your weekly benefit rate at 60% of the average weekly wage you earned during the base year, up to that maximum.we determine the average weekly wage based on wage information your employer(s) report.

Source: thumbor.forbes.com $40,000.00 salary example for employee and employer paying new jersey state tincome taxes. The weekly benefit rate is capped at a maximum amount based on the state minimum wage. Living wage calculation for new jersey.

Check out our new page tax change to find out how federal or state tax changes affect your take home pay. Living wage calculation for new jersey. Reset or change selection (click.

We will calculate your weekly benefit rate at 60% of the average weekly wage you earned during the base year, up to that maximum.we determine the average weekly wage based on wage information your employer(s) report. One of a suite of free online calculators provided by the team at. We will calculate your weekly benefit rate at 60% of the average weekly wage you earned during the base year, up to that maximum.we determine the average weekly wage based on wage information your employer(s) report.

Source: onpay.com The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. Detailed salary after tax calculation including new jersey state tax, federal state tax, medicare deductions, social security, capital gains and other income tax and salary deductions complete with supporting new jersey state tax tables. Fica contributions are shared between the employee and the employer.

However, the 6.2% that you pay only applies to income up to the social security tax cap, which for 2021 is $142,800 (up from $137,700 in 2020). This data also includes overtime payments, other miscellaneous payments, the agency where the person works, the job title, and, if the worker is in a union, the bargaining unit. This new jersey 401k calculator helps you plan for the future.

For 2021, the maximum weekly benefit rate is $731. Both buying and owning a home in new jersey is expensive. Calculates federal, fica, medicare and withholding taxes for all 50 states.

Source: www.viventium.com The top tax rate is one of the highest in the country, though only individual taxpayers whose taxable income exceeds $1,077,550 pay that rate. After a few seconds, you will be provided with a full breakdown of the tax you are paying. Calculates federal, fica, medicare and withholding taxes for all 50 states.

Check out our new page tax change to find out how federal or state tax changes affect your take home pay. New york's income tax rates range from 4% to 8.82%. In new jersey, unemployment taxes are a team effort.

Detailed salary after tax calculation including new jersey state tax, federal state tax, medicare deductions, social security, capital gains and other income tax and salary deductions complete with supporting new jersey state tax tables. Job seekers salary calculator program. Fica contributions are shared between the employee and the employer.

Source: bun.armiu419.pw The results are broken up into three sections: Detailed salary after tax calculation including new jersey state tax, federal state tax, medicare deductions, social security, capital gains and other income tax and salary deductions complete with supporting new jersey state tax tables. Homeowners in new jersey pay an average of $8,432 in property taxes annually, which equals an effective property tax rate of 2.42%, the highest in the nation.

New jersey homebuyers can expect to pay the highest property taxes in the country at an effective rate of 2.42%. So the fiscal year 2021 will start from july 01 2020 to june 30 2021. Living wage calculation for new jersey.

Salary ranges can vary widely depending on the city and many other important factors, including education, certifications, additional skills, the number of years you have spent in your profession. The new jersey salary calculator is a good calculator for calculating your total salary deductions each year, this includes federal income tax rates and thresholds in 2021 and new jersey state income tax rates and thresholds in 2021. The tool provides information for individuals, and households with one or two working adults and.

Source: comptiacdn.azureedge.net This calculator has been updated to use the new withholding schedules for 2017. Fica contributions are shared between the employee and the employer. This free, easy to use payroll calculator will calculate your take home pay.

Select a state to add state and local taxes. You only pay taxes on contributions and earnings when the money is withdrawn. This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs.

The tool provides information for individuals, and households with one or two working adults and. For a detailed calculation of your pay as a gs employee in new jersey, see our general schedule pay calculator. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local w4 information.

Thank you for reading about Nj Salary Calculator , I hope this article is useful. For more useful information visit https://labaulecouverture.com/

Post a Comment for "Nj Salary Calculator"